Modernize your onboarding experience

Sign up more real customers faster and with less risk across all channels with flexible, on-demand configuration and automated approvals.

Drive revenue and decrease costs

Fine tune your verification processes and risk appetite with full data and decisioning transparency to drive higher conversions and higher fraud deterrence.

Locate and approve more customers

Increase your market share of thin-file and hard-to-identify populations with thousands of diverse, authoritative data sources, IDs and biometrics.

Confidently verify more customers

Building trusted customer relationships has never been more critical. IDology’s ExpectID® platform delivers on-demand and completely configurable solutions that match your level of risk. With more interconnected layers you can close the gaps that are exploited by fraudsters and eliminate the need for multiple providers or vendors.

Our multi-layered approach ensures you have more inclusive ways to deliver the right verification experience at the right time. Customize and automate the verification experience to fit your risk tolerance, meet ever-evolving compliance standards, prevent fraud and avoid regulatory fines.

We allow you to fast track legitimate customers and apply friction only as needed to provide more assurance– all while delivering a dramatically better customer experience.

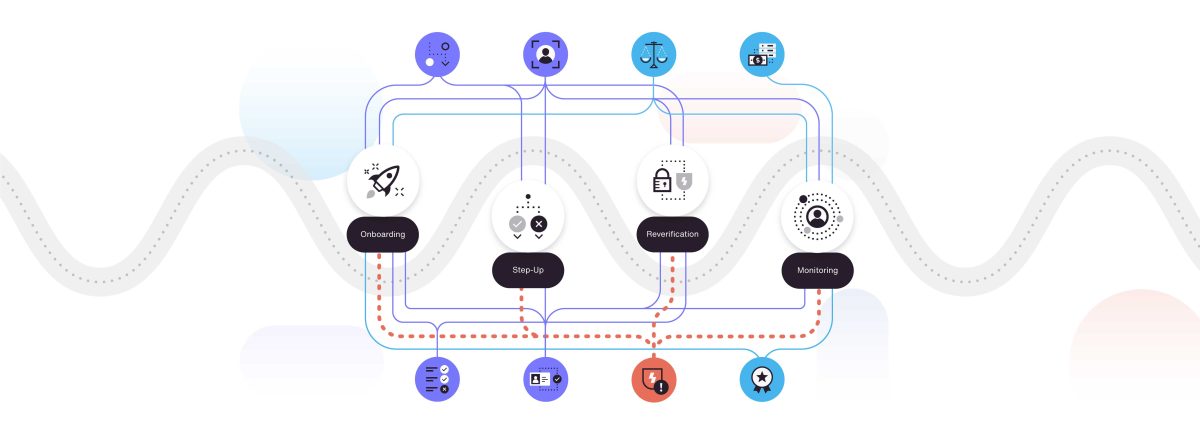

Journeys for the entire customer lifecycle

Identity Verification

Identity proofing to quickly establish customer trust with automated identity verification using data, documents and biometrics.

Regulatory Compliance

Address the full AML lifecycle and fight fraud with one intelligent platform to automate key compliance processes.

Fraud Management

Orchestrate a layered defense against evolving fraud with proprietary machine learning and human oversight.

Key benefits

Verify customers your way

Engage customers across any channel and device, including mobile, online, desktop scanners, kiosks and cross-device workflows (SMS to the web). We offer a wide range of integrated solutions (data, ID, biometric) that can be delivered individually, orchestrated in a custom workflow or configured to support multiple enterprises— all through one platform.

Match your level of risk

Get the identity assurance you need to support different risk levels in a secure, scalable and customer friendly way. Apply a risk-based approach favored by regulators to move each user through the right verification step at the right time. Escalate suspect identities to higher layers of authentication for the ultimate confidence and exceptional customer experience.

Make changes on demand

Keep pace with ever-changing regulations, market demands and business needs with time-saving point-and-click flexibility. Customize rules and settings, define your own decisioning workflows and programmatically decide who is safe to onboard– without burdening your IT team and while ensuring the customer experience is seamless, personalized and secure.

Utilize proven technology

Harness IDology’s intelligent orchestration, bringing together proven proprietary tech and leading global identity data for actionable insights. We analyze billions of records to connect relevant information in a way that’s easy, flexible and configurable. With user-friendly views and reports, you have a complete solution with rapid deployment options to get to market.